What it will take to close the super gap between men and women

There’s a lot of talk about in how to close the super gap between men and women, with women often retiring with far less than men.

The main drivers of this are due to women both earning less and taking time out of the workforce to care for children and other family members.

In a previous column, I discussed steps women and their partners can take to close this gap.

A new report from Women in Super and research firm Rice Warner reinforces the risks that the gender gap poses for women and offers data on the roots of the problem.

Previous research showed that because women have less in super and rely more heavily on the age pension, they are more likely than men to face financial insecurity and poverty in retirement.

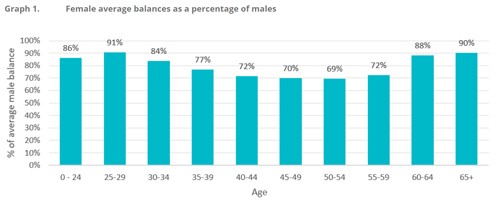

As you can see from the Rice Warner data in the chart below, the super gap starts to widen when women are in their 30s, suggesting that taking time out of the workforce to rear children diminishes income and super contributions.

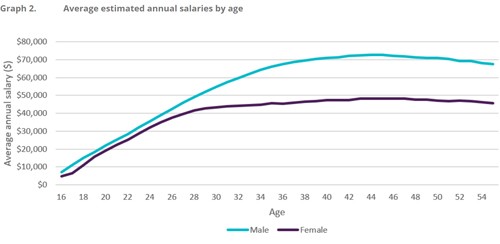

The research also demonstrates that women start out their careers with pay that is close to their male counterparts, only to see a gap emerge as women enter their 20s and 30s. The source of this divergence is not clear, but one likely cause is that women are more likely to leave work to take care of children or family members, missing out on years in the workforce when promotions and pay raises are most likely.

Investment research shows that men tend to invest more aggressively than women, but Rice Warner said this difference did not contribute significantly to the super gap.

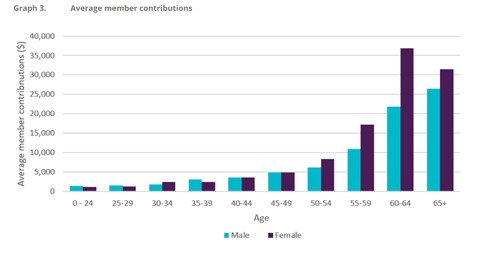

The positive news is that women are taking action to close the gap. They contribute more to super, especially as they approach retirement, which boosts their balances at a crucial stage.

Many women don’t earn enough to make extra contributions, however, and those who do likely can’t compensate enough for years of reduced earnings and super guarantee payments. The roots of the super pay gap are many — gender inequality, the challenges and costs of child care and super policy. Fixing the problem will require changes on all those fronts.

Written by Robin Bowerman

Head of Corporate Affairs at Vanguard.

21 May 2019

vanguardinvestments.com.au